Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

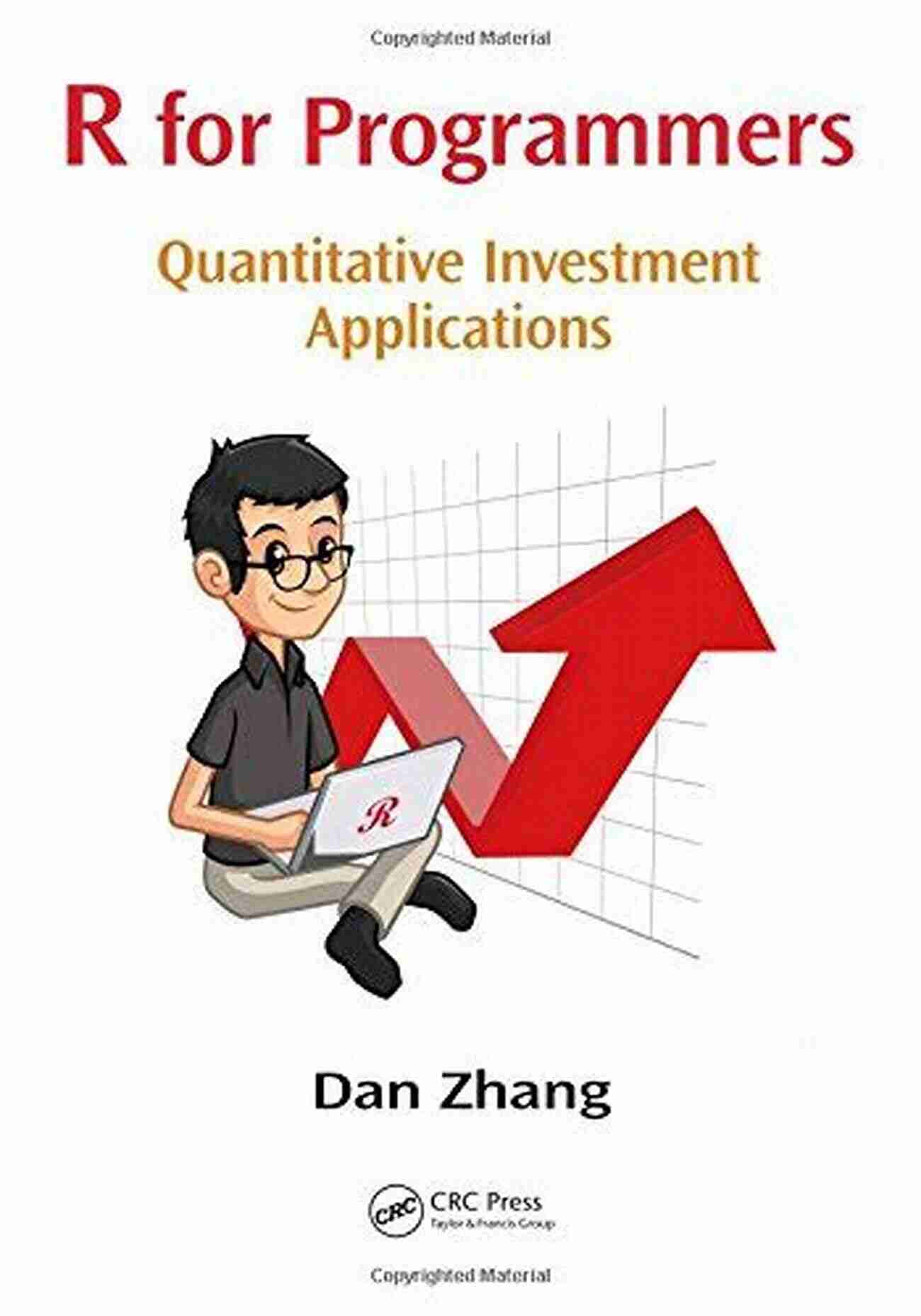

For Programmers: Exploring the World of Quantitative Investment Applications

In today's fast-paced financial landscape, technology plays a crucial role in making informed investment decisions. Programmers with expertise in quantitative analysis have a unique advantage when it comes to developing cutting-edge software solutions for the finance industry. In this article, we will dive deep into the world of quantitative investment applications, exploring the intricacies and opportunities it offers to programmers.

Table of Contents

- Quantitative Analysis in Investment

- Building Investment Applications

- Tech Advancements and Tools

- Machine Learning in Investment Strategies

- Challenges and Future Perspectives

Quantitative investment involves using mathematical models and statistical analysis to make investment decisions. Programmers with strong analytical and coding skills play a critical role in the development of quantitative investment applications. These applications leverage large datasets and complex algorithms to identify profitable investment opportunities and optimize portfolio performance.

With the increasing availability of market data, the demand for programmers skilled in quantitative analysis and investment applications has grown significantly. This article aims to provide programmers with insights into the world of quantitative investment, uncovering the diverse applications and opportunities it presents.

5 out of 5

| Language | : | English |

| File size | : | 26267 KB |

| Screen Reader | : | Supported |

| Print length | : | 386 pages |

Quantitative Analysis in Investment

Quantitative investment applications rely on data-driven analysis to gain a competitive edge in the financial markets. By employing statistical models and mathematical techniques, programmers can identify patterns and trends in market data and make informed investment decisions based on data-driven insights.

Statistical analysis, risk modeling, factor evaluation, and predictive modeling are among the essential techniques used in quantitative investment. Programmers proficient in programming languages such as Python, R, or MATLAB can develop algorithms that analyze vast datasets and generate trading signals.

Building Investment Applications

Programmers skilled in quantitative analysis can build investment applications that automate trading strategies, manage portfolios, and provide real-time market analysis. These applications enable investors to make informed decisions quickly and efficiently, improve risk management, and optimize investment performance.

Developing quantitative investment applications requires a strong understanding of finance, markets, and investment theories. Programmers need to collaborate closely with investment professionals to translate complex strategies into code and create robust, reliable, and scalable software solutions.

Tech Advancements and Tools

Advancements in technology have revolutionized quantitative investment applications. High-performance computing systems, big data analytics, and cloud computing have made it possible to process massive amounts of financial data and perform complex computations in real-time.

Sophisticated data visualization tools allow programmers and investors to gain better insights into market trends and patterns. These tools provide interactive visual representations of data, making it easier to identify significant investment opportunities and potential risks.

Machine Learning in Investment Strategies

Machine learning techniques have brought about new possibilities in investment strategies. Programmers can develop algorithms that can learn from historical data, adapt to changing market conditions, and make predictions with high accuracy.

Applications of machine learning in quantitative investment include sentiment analysis of news and social media data, predictive models analyzing alternative data sources, and automated trading algorithms. Programmers knowledgeable in machine learning frameworks like TensorFlow or PyTorch are in high demand in the finance industry.

Challenges and Future Perspectives

While the world of quantitative investment applications offers tremendous opportunities, it also poses several challenges. Programmers need to continuously adapt to new technologies, stay updated with the latest market trends, and maintain the integrity and security of financial data.

Additionally, ethical considerations become crucial when developing investment applications. Fairness, explainability, and bias-free models are critical aspects for programmers to address.

Looking ahead, the future of quantitative investment is bright. As technology continues to advance, programmers will play a fundamental role in developing innovative investment solutions, integrating artificial intelligence, and exploring new avenues in portfolio optimization and risk management.

, programmers with expertise in quantitative analysis have a unique opportunity to be at the forefront of finance and technology. By building sophisticated investment applications, programmers can empower investors with data-driven insights, streamline processes, and contribute to the growth of the finance industry as a whole.

Programmers: Explore the World of Quantitative Investment Applications

5 out of 5

| Language | : | English |

| File size | : | 26267 KB |

| Screen Reader | : | Supported |

| Print length | : | 386 pages |

After the fundamental volume and the advanced technique volume, this volume focuses on R applications in the quantitative investment area. Quantitative investment has been hot for some years, and there are more and more startups working on it, combined with many other internet communities and business models. R is widely used in this area, and can be a very powerful tool. The author introduces R applications with cases from his own startup, covering topics like portfolio optimization and risk management.

Samuel Ward

Samuel WardTake Control Of Your Network Marketing Career

Are you tired of working...

Bryson Hayes

Bryson HayesThe Enigmatic Talent of Rype Jen Selk: A Musical Journey...

When it comes to musical prodigies,...

Norman Butler

Norman ButlerUnveiling the Rich History and Poetry of Shiraz in...

When it comes to the cultural...

Cade Simmons

Cade SimmonsHow Impatience Can Be Painful In French And English

: In today's fast-paced world, impatience...

William Shakespeare

William ShakespeareSewing For Sissy Maids - Unleashing Your Creative Side

Are you ready to dive...

Harry Hayes

Harry HayesGST Compensation to States: Ensuring Fiscal Stability...

In the wake of the COVID-19 pandemic,...

Rodney Parker

Rodney ParkerLearn How to Play Blackjack: A Comprehensive Guide for...

Blackjack, also known as twenty-one, is one...

Wade Cox

Wade CoxComplete Guide Through Belgium And Holland Or Kingdoms Of...

Welcome, travel enthusiasts, to a...

Jack Butler

Jack Butler15 Eye Popping Projects To Create with Felt Decorations

Felt decorations have become a popular craft...

Dennis Hayes

Dennis HayesFirst Aid For Teenager Soul Mini Book Charming Petites...

The teenage years can...

Brett Simmons

Brett SimmonsFrom Fear To Freedom - Overcoming Your Fears and Living a...

Are you tired of living in...

Carl Walker

Carl WalkerSmoking Ears And Screaming Teeth: The Shocking Truth...

Smoking has long been known to cause a host of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Bernard PowellThe Shocking Truth Behind The Financial Crisis Of Abolition: How Greed and...

Bernard PowellThe Shocking Truth Behind The Financial Crisis Of Abolition: How Greed and... Miguel NelsonFollow ·4.4k

Miguel NelsonFollow ·4.4k Banana YoshimotoFollow ·3.7k

Banana YoshimotoFollow ·3.7k Emanuel BellFollow ·3.7k

Emanuel BellFollow ·3.7k Jackson HayesFollow ·12.7k

Jackson HayesFollow ·12.7k Andrew BellFollow ·15.6k

Andrew BellFollow ·15.6k Marc FosterFollow ·17.5k

Marc FosterFollow ·17.5k Isaias BlairFollow ·19.7k

Isaias BlairFollow ·19.7k Benji PowellFollow ·4.7k

Benji PowellFollow ·4.7k